Accounting students help VITA

March 24, 2011

As April 18 looms over the heads of tax payers, Simpson students are tuning in to their volunteer side and doing their part to help others less fortunate get through the tax season.

In order to help cope with those worries, Volunteer Income Tax Assistance (VITA) is there to help by offering to do taxes for low to middle income individuals or families.

Shane Cox, assistant professor of accounting, really pushed for his students to participate in the organization.

“I really tried to push it because all the information they learned in individual income tax could be put to use in an actual tax preparation environment,” Cox said.

Cox thinks that VITA helps teach things that can’t be taught in the classroom.

“In accounting, what students I think lack in the classroom is working with the public,” Cox said.”So this also gives them that exposure of working with the public and also serving low-income individuals. I think that’s a great outcome of the program.”

Junior Elsen Hoxhalli took part in VITA due to being in one of Cox’s classes and hearing about it through an email.

“This year one of the VITA recruiters came to speak at our income tax class, which was pretty convenient because that’s what we were studying in that class anyway,” Hoxhalli said.

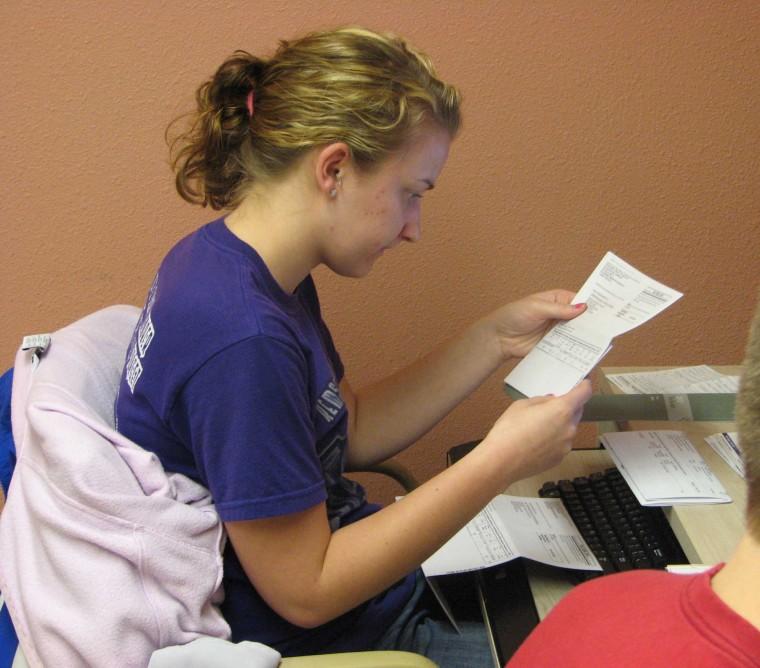

Junior Nicole Olson also participated in VITA for the first time this year.

“I would definitely recommend it, especially to any accounting student,” Olson said. “It’s really good experience. I feel like I’m learning a lot more actually preparing the taxes than I did sitting in the classroom learning about it.”

While the students apply their knowledge outside of the classroom they are volunteering and, in turn, living up to the Simpson mission.

“Plus, what I like about it is not only are they doing taxes, but they are tying into the community service mission of Simpson,” Cox said. “They are preparing those taxes for free.”

The volunteers of VITA can’t be just anyone, though. They must attend class sessions and become certified.

“We had to attend two classes on Saturdays, and they were both four hours,” Olson said. “And then we had to take tests online in order to be certified. There was like three different tests.”

Based on how well the tests went, determined what level of tax returns a volunteer could handle.

“You could take a basic, intermediate, or advanced test,” Olson said.”So whatever you passed, that was the level of tax returns you could do.”

Students may earn one hour worth of credit in exchange for volunteering for 40 hours.

“You can actually get credit for it through the college,” Olson said. “So we get one credit for it, and it’s just based on how many hours you volunteer. We are registered for 40 hours.”

Cox doesn’t give out any kind of reward for those who participate, but is happy for the students of his who do participate.

“I’m really proud of all of them,” Cox said. “It’s them fulfilling their internal desire to serve the community.”

VITA works throughout the tax season and is open at the We-LIFT Mondays and Tuesdays from 4-8 p.m.