Tuition increase concerns lead to town hall

February 10, 2021

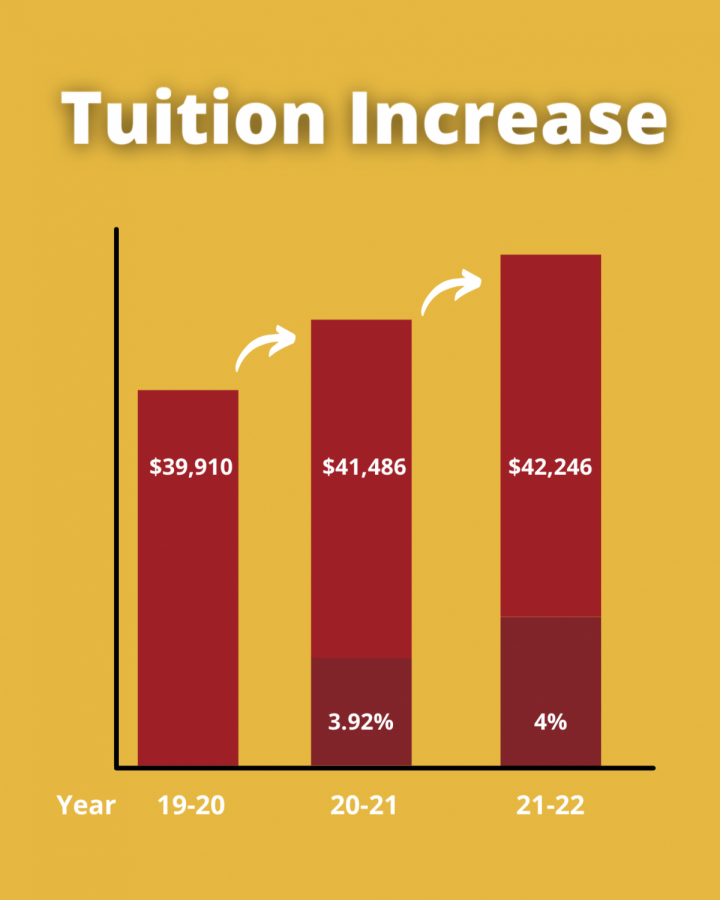

Members of Simpson College administration met Thursday with parents and students to talk about campus changes–including a 4% increase in tuition for the 2021-2022 academic year.

On Jan. 4, President of Student Body Jorge Castelan and Vice President of Student Body Chase Henry sent a joint email to fellow students about the recent tuition, room, and board increase. According to the email, Castelan and Henry spoke with President Kelliher and a plan to address concerns was established.

“During the meeting, the Board of Trustees’ process and the plan for moving forward in relation to budgeting, investments in campus, and the overall Simpson experience for the future will be explained and discussed in-depth,” the email said. “This will also give students and parents the opportunity to express their concerns about the tuition increase.”

According to Vice President for Business and Finance Philip Peña, when approving the 4% increase of tuition, room and board, the board of trustees considered the impact the coronavirus has on the finances of students and their families, as well as concerns about safety on campus which has brought additional costs. Other projects on campus, such as renovating Dunn Library and initiating a $5.8 million energy project, are investments the College is pursuing.

“This will upgrade and manage the electric equipment we use on campus, provide new heating and cooling throughout the campus, new campus lighting to reduce our electrical needs and provide a safer well-lit campus,” Peña said. “It will also analyze and design for new solar panel systems on campus for ride plumbing upgrades including the cafeteria kitchen,” Peña said.

According to Peña, even with the college’s additional costs and the increased tuition and room and board, education at Simpson costs less than other, similar colleges. Tuition and fees at Simpson currently cost $42,246; room and board cost $9,282. Total expenses amount to $51,528. According to Peña, Simpson College is between Drake University and the University of Dubuque regarding total comparable expenditures. In terms of average net price, Simpson College is between Coe College and Grandview University, standing at $20,145.

“All students enrolled full-time during the 2020-21 academic year, and who meet certain requirements, will be eligible for a fifth year at the college tuition-free,” Peña said. “Financial aid awards for 2021-22 will be posted to SC Connect in early January. We recognize and appreciate you are making a substantial investment in pursuit of your future-proofed education at Simpson College.”

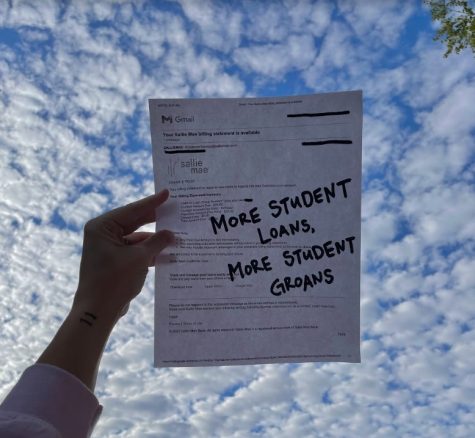

According to Assistant Vice President for Enrollment & Financial Assistance Tracie Pavon, applications will be reviewed on a weekly basis until all funds are depleted. Simpson College will receive $1.4 million, which will be used to pay for costs brought on by the coronavirus and compensate for the revenue lost due to the inability to host camps or hold athletic events and a lack of ticket sales.

“Right now, faculty, staff and administration are looking hard at the two previous full years to be able to demonstrate what that last revenue looks like,” Pavon said. “And whatever is left after those things are done could also be issued to students in the form of grants.”

Pavon also spoke about special circumstances, and FAFSA overrides. According to Pavon, 2019 income is legally required when completing the FAFSA, but she has the authority to override that FAFSA to reflect a family’s financial situation more accurately. Loss of employment, especially due to coronavirus, a divorce where the income is split, an unusually high medical or dental expense within the family that is not covered by insurance are examples of special circumstances that could warrant a FAFSA override.

According to Pavon, recipients of the Pell Grant will receive a portion of the new source of funds this semester, which could lower the bill. However, Pavon also stressed the federal government requires Simpson College to write a check. “It’s confusing when we cut you a check, and you still owe us money,” Pavon said. “So we will be sending an application out with a confirmation button that you simply have to hit that says, ‘credit my student account.’ Now, if your credit–your student account–is paid, we will be issuing you a check anyway. We’re going to recommend that you do that, but that’s all we can do: recommend.”

According to Vice President for College Advancement Bob Lane, Simpson College’s capital campaign “Imagine the Impact,” which was completed in October 2020, had a $25 million goal; the end of the campaign saw $30.7 million in gifts and pledges. Lane went on to explain how those funds were committed.

According to Lane, the Imagine the Impact campaign fell into three categories: capital funds, the annual fund and restricted funds. The capital funds are designated for specific projects and equipment, one of which will be a major renovation of Dunn Library. Other funds were committed to scholarships, research, travel and scientific equipment.

“The annual fund is our unrestricted operating support that we receive each year we average in annual fund support from alumni, parents, friends and trustees,” Lane said.“Those funds are spent on an annual basis to support the operations [investments]. The restricted funds are gifts that come with certain parameters on how those funds will be used. If you add all those up, that total is $30.7 million.”

According to the National Center for Education Statistics, the cost of Simpson College’s tuition and fees has increased over the last ten years by 50.92%